This article was created specifically for individuals looking to predict the alterations and possibilities related to the Income Tax.

In this document, you will discover a brief overview of the Income Tax Return for 2025. It includes details about the progressive tax rates, which are essential for advising your clients.

IRPF in 2025: Key Dates, Obligated Individuals, and Required Paperwork

Income Tax 2025 upholds regulations that necessitate careful consideration and planning.

Taxpayers who are typically obligated to file taxes are those who:

- They earned taxable incomes over R$ 30,639.90.

- They received income above R $ 200 thousand that was either exempt or taxed only at the source.

- Their yearly earnings from rural activities exceeded R$ 153,199.50.

- They owned assets and entitlements (including undeveloped land) valued at over R$ 800,000.

- They conducted activities on the Stock Exchange or made profits from selling goods.

- Became a resident in Brazil in 2024.

The deadlines for filing this year’s tax return, according to IRPF 2024, are expected to commence between March 15-17 and end on May 31. (Official announcements will be made by the IRS in early March)

Gathering documents such as income reports from various sources, proof of medical and educational expenses, alimony payments, and records of buying and selling goods is essential.

Access our full article “Income Tax 2025 [Guide]” for further information and practical advice if you want to delve deeper.

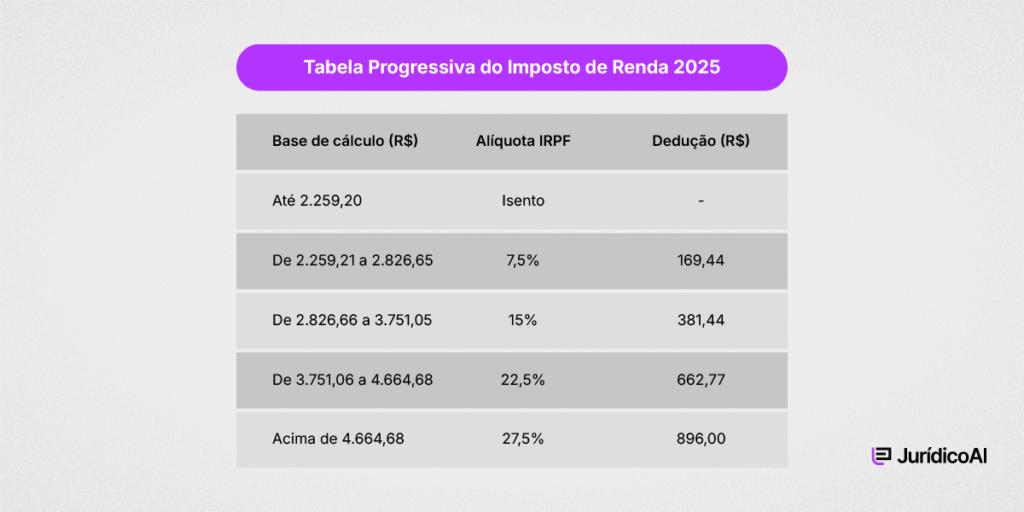

Progressive Income Tax Chart for 2025

The conventional Progressive Table of the IRPF 2025 arranges the tax rates based on income brackets.

There will be no modifications in the table for 2025, staying the same as the 2024 IRPF.

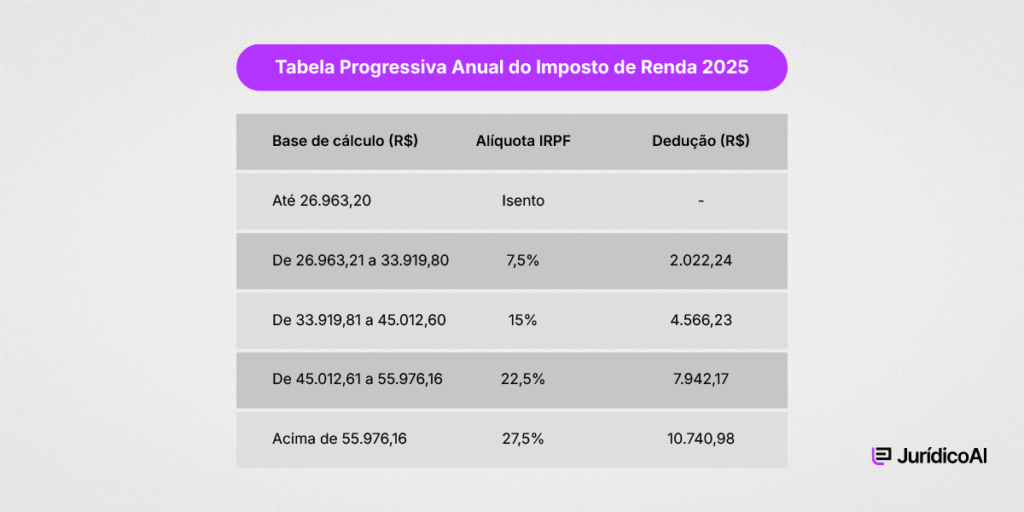

Income Tax 2025 Annual Progressive Table

The Annual Progressive Table is a different option that modifies the yearly earnings and deduction thresholds.

Achieving Fiscal Excellence: Strategize, Coordinate, and Achieve Results

Anticipating changes in the IRPF is crucial for preventing unexpected outcomes and ensuring an accurate tax return.

Understanding the importance of deadlines, required standards, and distinctions among progressive charts enables efficient scheduling.

References:

The web address is http://www.gov.br/revenueagency/en-us/topics/my-taxation/tables/2024.

What does the Progressive Table of IRPF 2025 refer to?

The structure determines the tax rates and income brackets used for tax calculations, with higher rates applied as the taxable amount increases.

What sets the Traditional Progressive Table apart from the Annual version?

The conventional method uses set guidelines, whereas the yearly method adapts based on the individual’s annual earnings.

When are the deadlines for filing IRPF 2025?

The statement is expected to start from March 15 to 17 and continue until May 31.

Who needs to report income tax for 2025?

Contributors who meet certain criteria such as having incomes over R$ 30,639.90, exempt income exceeding R$ 200,000, and so on, are required to make a declaration.

What paperwork is needed for the IRPF 2025 declaration?

Income statements, evidence of medical and educational costs, transaction records, dependent CPF, and other documents are necessary.

How can the IRPF 2025 declaration program be accessed?

The program is available through the e-CAC Portal, My Income Tax Application, or the Declaration Generator Program (PGD) for offline completion.

How should differences in the statement be addressed?

If there are discrepancies, you can send a correcting statement to fix mistakes and prevent issues with the Federal Revenue Service.

How does the refund process for IRPF 2025 operate?

The reimbursement is distributed gradually, with a focus on individuals who submit accurate tax returns without any missing information, giving priority to seniors and individuals with special needs.

Main deductions permitted in IRPF 2025.

Deductions such as medical costs, education expenses, retirement savings, spousal support, and people you support financially can be subtracted from the total amount used in calculations.

Where can I locate additional details regarding the IRPF 2025 table?

For more detailed and current information, check our articles and adhere to the guidelines provided by the IRS and expert tax advisors.